The Facts About Pvm Accounting Uncovered

The Facts About Pvm Accounting Uncovered

Blog Article

The Greatest Guide To Pvm Accounting

Table of ContentsThe Main Principles Of Pvm Accounting A Biased View of Pvm AccountingAn Unbiased View of Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Talking About6 Simple Techniques For Pvm AccountingPvm Accounting for BeginnersHow Pvm Accounting can Save You Time, Stress, and Money.

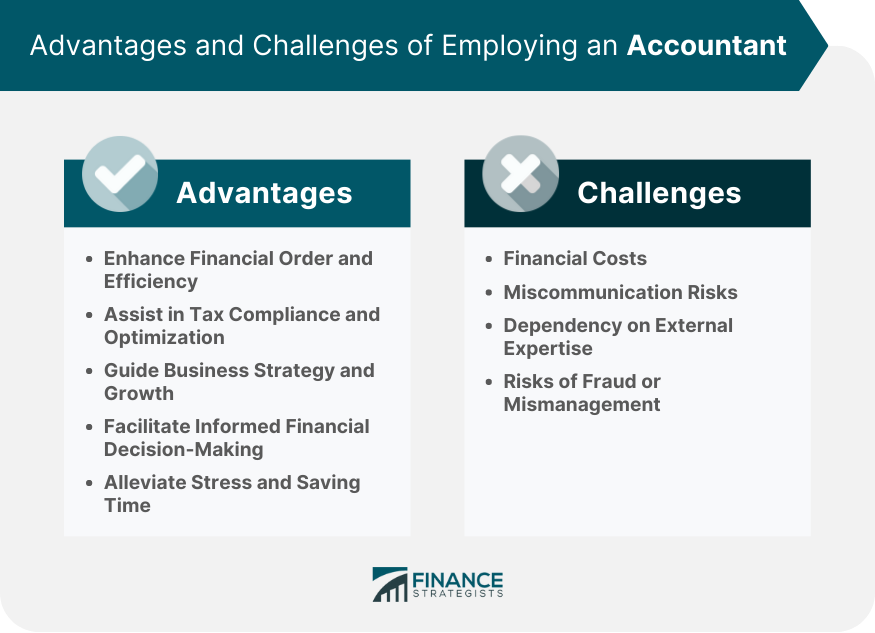

When you have a handful of options for a tiny service accounting professional, bring them in for brief meetings. https://sketchfab.com/pvmaccount1ng. Company owner have numerous other responsibilities tailored in the direction of development and development and do not have the moment to manage their finances. If you own a small company, you are likely to take care of public or exclusive accounting professionals, who can be hired for an internal solution or outsourced from an accountancy firmAs you can see, accountants can assist you out during every phase of your firm's development. That doesn't mean you have to work with one, yet the ideal accounting professional should make life less complicated for you, so you can focus on what you like doing. A CPA can aid in tax obligations while likewise supplying clients with non-tax services such as bookkeeping and monetary encouraging.

The Basic Principles Of Pvm Accounting

Hiring an accounting professional lowers the possibility of declaring imprecise paperwork, it does not totally eliminate the opportunity of human mistake impacting the tax return. A personal accountant can aid you intend your retirement and likewise withdrawl.

This will certainly help you produce a business plan that's practical, expert and extra likely to prosper. An accounting professional is an expert that oversees the monetary wellness of your business, everyday. Every small company owner ought to take into consideration hiring an accounting professional before they really require one. Additionally, personal accounting professionals permit their clients to save time.

The smart Trick of Pvm Accounting That Nobody is Talking About

They'll likewise likely included a valuable expert network, as well as knowledge from the successes and failings of businesses like yours. Hiring a Licensed Public Accounting professional that recognizes https://turbo-tax.org/why-you-should-hire-an-accountant-for-your/ set property accounting can correctly value your realty while remaining on top of elements that impact the numbers as time goes on.

Your accountant will likewise give you a sense of necessary startup prices and financial investments and can reveal you just how to keep working even in periods of decreased or negative cash circulation. - https://papaly.com/categories/share?id=68088867b12d499ba0c7f98a5074ae01

Facts About Pvm Accounting Revealed

Filing taxes and handling financial resources can be especially testing for tiny service owners, as it requires knowledge of tax obligation codes and economic guidelines. A Licensed Public Accountant (CPA) can offer indispensable support to small organization proprietors and aid them navigate the complicated world of finance.

: When it comes to accounting, accountancy, and monetary planning, a certified public accountant has the understanding and experience to help you make informed choices. This experience can conserve local business proprietors both time and cash, as they can rely upon the certified public accountant's understanding to ensure they are making the ideal economic selections for their company.

Facts About Pvm Accounting Uncovered

CPAs are educated to stay updated with tax obligation laws and can prepare precise and prompt income tax return. This can save local business owners from frustrations down the line and ensure they do not deal with any type of fines or fines.: A CPA can likewise aid local business proprietors with economic planning, which includes budgeting and projecting for future development.

: A CPA can likewise supply beneficial understanding and evaluation for little service owners. They can help determine areas where business is prospering and areas that require renovation. Armed with this info, small company owners can make modifications to their procedures to optimize their profits.: Lastly, working with a CPA can offer small company proprietors with comfort.

What Does Pvm Accounting Do?

The government will not have the funds to supply the services we all depend upon without our taxes. For this factor, everyone is urged to organize their taxes prior to the due date to guarantee they avoid charges.

The size of your tax obligation return depends on several elements, including your income, deductions, and credit scores. Because of this, hiring an accountant is recommended due to the fact that they can see whatever to guarantee you obtain the optimum quantity of money. Regardless of this, lots of people reject to do so since they believe it's nothing even more than an unnecessary cost.

What Does Pvm Accounting Do?

When you hire an accountant, they discover this can assist you prevent these errors and guarantee you get one of the most refund from your tax obligation return. They have the expertise and know-how to recognize what you're qualified for and just how to obtain one of the most cash back - financial reports. Tax obligation period is often a stressful time for any taxpayer, and for a good reason

Report this page